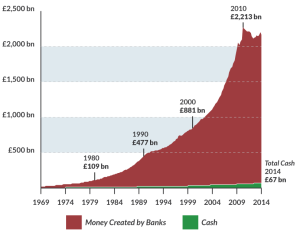

Just as with yesterday’s post, sometimes it takes a visualisation to really ram home a point. Regardless of whether the boiling frog anecdote is true or not, I think most people would agree that the image below shows that we’re facing a pretty big issue within our current financial system.

Check out this quote from the Positive Money website:-

From the time when the Bank of England was formed in 1694, it took over 300 years for banks to create the first trillion pounds. It took them only 8 years to create the second trillion. Today cash – the green area at the bottom of the chart below – accounts for just 3% of the total money in the economy. The red area – money created by commercial banks – accounts for the other 97%.

This seems to me to be a particularly telling statistic because it helps to explain part of the attraction of crypto-currencies for so many.

During any ‘Bitcoin for Beginners’ talk, the speaker will usually explain how our money isn’t backed by gold any longer. At this stage, most people in the audience chuckle contentedly away to themselves, safely within their comfort zone. Then the explanation inevitably follows that in fact, as shown above, most money is actually created out of thin air by commercial banks who literally lend it into existence. At this point, in my experience, the atmosphere always subtly changes in the room.

For more information, take a look at the recent report from the Bank of England (‘Money Creation in the Modern Economy’).

Now it’s easy to see why many people are so attracted to the one of the principles that underpins Bitcoin – specifically that the rules about the supply of money should be agreed in advance. For many, a runaway train holds little appeal.